Colorado residents who want to ensure a trusted loved one has seamless access to handle their financial affairs or make medical decisions during periods of lifetime incapacity can create power of attorney documents.

Financial power of attorney colorado.

Colorado power of attorney allows a resident of the state to choose an agent to make financial related or health care decisions on their behalf.

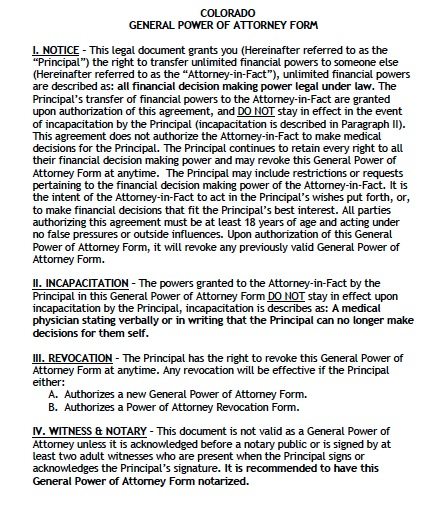

A colorado financial power of attorney also known as a general power of attorney allows your agent to make financial decisions for you.

The colorado financial power of attorney form is a legal instrument that offers another person the right to administer your financial transactions.

This type of form continues in effect even if the individual granting authority becomes incapacitated or mentally incompetent to make decisions for themselves.

Some of these decisions may be related to buying and selling a property banking business and other financial matters.

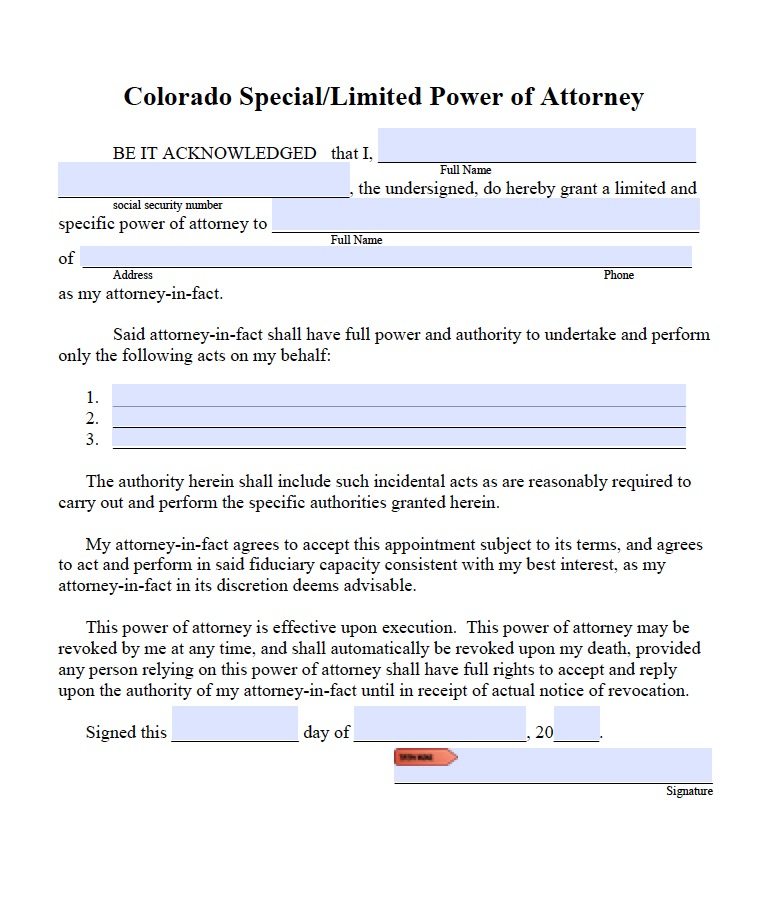

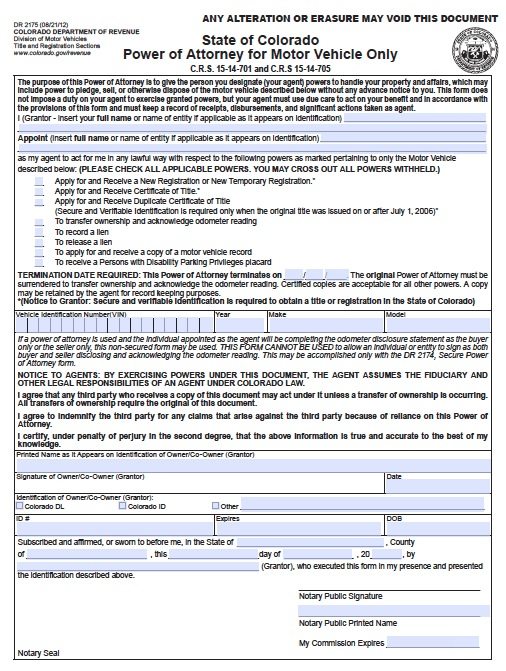

Here are some of the specified provisions under colorado law.

Colorado durable financial power of attorney form allows an individual to empower another person usually a family member or close friend with the authority to act on that individual s behalf in the event the individual is unable or unavailable to act for themselves.

The authorization is regarded as durable which guarantees it remains in effect even if you are psychologically or physically incapable of choosing on your own.

Typical decisions include the ability to pay bills cash checks access your bank accounts and make other financial decisions you would typically make on a daily basis.

There are six forms available each designed to serve a unique purpose from making end of life decisions for the principal to providing an agent with the permission to file income taxes.

To be valid powers of attorney in colorado must meet certain requirements.