A recent u s government study found that solar homes sold for approximately 5 500 kw more than non solar homes.

Estimated useful life for solar panels for depreciation.

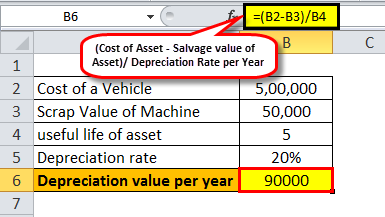

It looks like solar panels have a 5 year life.

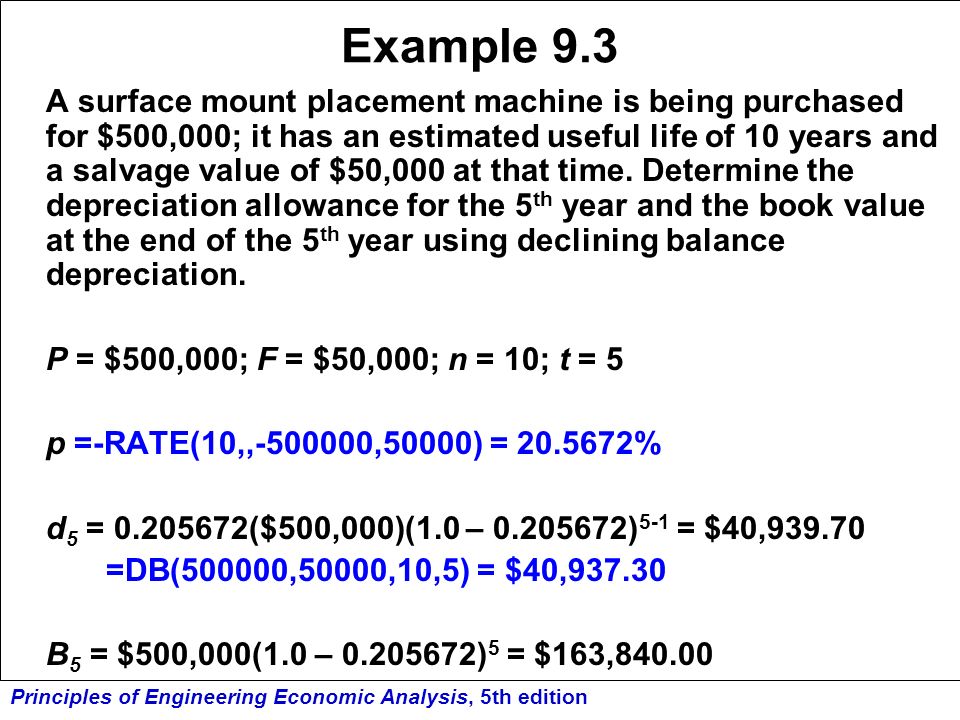

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated.

Macrs is the method of depreciation used for most property though assets vary by class which determines the depreciable life or cost recovery period of the property.

Class depreciation timeframes vary between three and 50 years depending on the certain type of property.

Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

Over 25 years that adds up to a total of 6 96 meaning your panels will operate at 93 04 of their original capacity in 2045.

Solar site assessors use these rates.

Photovoltaic electricity generating system assets incorporating photovoltaic panels mounting frames and inverters 20 years.

However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

Rental hiring and real estate services 66110 to 67200.

Degradation rates are used in solar site assessments in order to estimate the energy production over the life of a system and to calculate the payback period and return on investment.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels.

Residential property operators 67110.